All Categories

Featured

Table of Contents

This policy layout is for the consumer who needs life insurance policy yet would certainly like to have the ability to choose how their cash value is invested. Variable policies are financed by National Life and dispersed by Equity Providers, Inc., Registered Broker/Dealer Associate of National Life Insurance Policy Firm, One National Life Drive, Montpelier, Vermont 05604.

The insurance company will pay out the face amount straight to you and end your policy. Contrastingly, with IUL policies, your fatality benefit can enhance as your money worth expands, bring about a potentially higher payout for your beneficiaries.

Find out about the numerous benefits of indexed global insurance coverage and if this kind of policy is ideal for you in this insightful post from Safety. Today, many individuals are taking a look at the worth of long-term life insurance with its capability to provide long-term protection along with money value. indexed universal life (IUL) has actually come to be a popular choice in offering long-term life insurance coverage security, and an also greater potential for growth with indexing of passion credits.

What is a simple explanation of Indexed Universal Life Cash Value?

What makes IUL different is the means interest is attributed to your plan. In enhancement to supplying a typical declared rate of interest, IUL provides the possibility to make passion, based on caps and floors, that is connected to the performance of a chosen choice of market indices such as the S&P 500, Dow Jones Industrial Standard or the Nasdaq-100.

With IUL, the policyholder determines on the quantity designated among the indexed account and the dealt with account. This implies you can pick to contribute more to your policy (within government tax obligation law limits) in order to aid you construct up your cash value even faster.

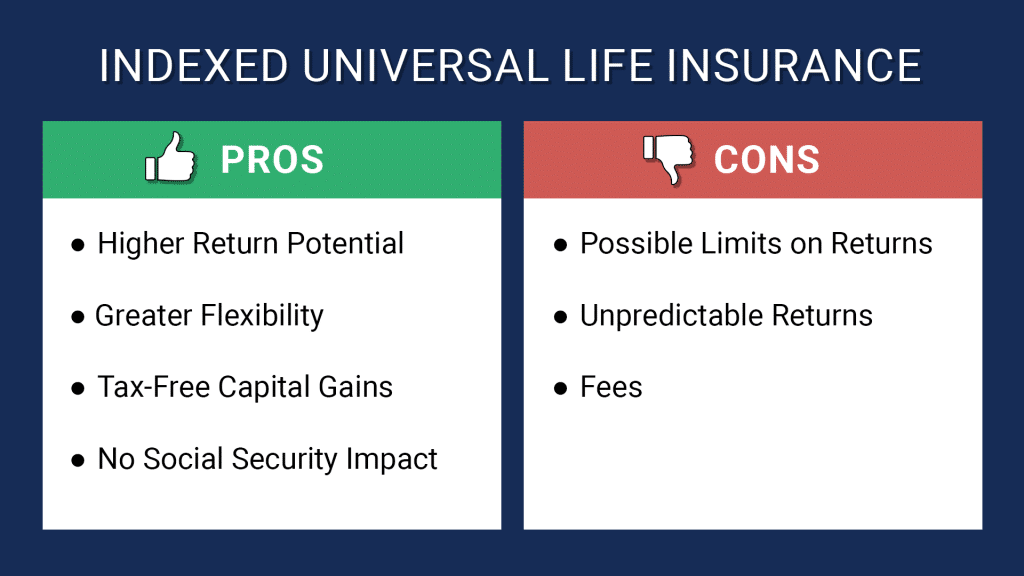

As insurance policy plans with investment-like functions, IUL plans charge payments and fees. These costs can minimize the cash money value of the account. While IUL policies additionally offer assured minimal returns (which might be 0%), they also cover returns, also if your select index overperforms (IUL vs whole life). This indicates that there is a limitation to price of money worth growth.

Composed by Clifford PendellThe benefits and drawbacks of indexed universal life insurance (IUL) can be challenging to make sense of, especially if you are not knowledgeable about just how life insurance policy works. While IUL is among the hottest items on the market, it's likewise one of one of the most unpredictable. This sort of insurance coverage may be a feasible alternative for some, but for lots of people, there are far better choices avaiable.

What is the most popular Indexed Universal Life Companies plan in 2024?

If you have an adverse return, you will not have an adverse crediting rate. Rather, the rate will usually be 0 or 1 percent. Furthermore, Investopedia listings tax obligation benefits in their advantages of IUL, as the survivor benefit (money paid to your recipients after you die) is tax-free. This holds true, yet we will include that it is additionally the instance in any kind of life insurance policy policy, not simply IUL.

The one point you require to know concerning indexed global life insurance policy is that there is a market danger involved. Spending with life insurance policy is a different game than acquiring life insurance coverage to shield your family, and one that's not for the pale of heart.

As an example, all UL items and any basic account product that relies on the efficiency of insurance firms' bond profiles will undergo rate of interest risk."They proceed:"There are integral dangers with leading customers to believe they'll have high rates of return on this item. A customer could slack off on moneying the money value, and if the plan doesn't execute as expected, this can lead to a gap in insurance coverage.

In 2014, the State of New york city's insurance regulator penetrated 134 insurers on how they market such policies out of worry that they were overemphasizing the prospective gains to customers. After continued examination, IUL was struck in 2015 with regulations that the Wall Street Journal called, "A Dosage of Reality for a Hot-Selling Insurance Policy Item." And in 2020, Forbes released and article titled, "Appearing the Alarm on Indexed Universal Life Insurance Policy."Regardless of numerous articles alerting customers concerning these policies, IULs continue to be one of the top-selling froms of life insurance policy in the USA.

How do I choose the right Iul Interest Crediting?

Can you take care of seeing the stock index carry out badly knowing that it straight impacts your life insurance coverage and your capability to shield your household? This is the final intestine check that hinders also very affluent financiers from IUL. The entire point of acquiring life insurance policy is to decrease threat, not create it.

Discover more regarding term life right here. If you are trying to find a plan to last your whole life, take an appearance at assured universal life insurance policy (GUL). A GUL policy is not practically long-term life insurance policy, yet instead a hybrid in between term life and global life that can enable you to leave a tradition behind, tax-free.

Your cost of insurance policy will not transform, even as you obtain older or if your health and wellness modifications. You pay for the life insurance defense just, just like term life insurance coverage.

What is the difference between Iul Death Benefit and other options?

Guaranteed global life insurance policy is a fraction of the expense of non-guaranteed global life. You don't risk of losing insurance coverage from undesirable investments or modifications out there. For an extensive comparison in between non-guaranteed and guaranteed global life insurance coverage, visit this site. JRC Insurance Team is right here to help you discover the appropriate plan for your demands, with no extra expense or fee for our aid.

We can retrieve quotes from over 63 premier carriers, enabling you to look beyond the big-box firms that commonly overcharge. Start currently and call us toll-free at No sales pitches. No stress. No obligations. Consider us a pal in the insurance policy sector who will certainly keep an eye out for your ideal rate of interests.

Who offers Flexible Premium Iul?

He has actually aided hundreds of family members of businesses with their life insurance policy requires given that 2012 and specializes with applicants that are much less than best wellness. In his leisure he takes pleasure in spending quality time with family, taking a trip, and the fantastic outdoors.

Indexed universal life insurance policy can help cover several economic needs. It is just one of several kinds of life insurance coverage available.

Table of Contents

Latest Posts

Index Universal Life Insurance Tax Free

Universal Life Target Premium

Vul Vs Iul

More

Latest Posts

Index Universal Life Insurance Tax Free

Universal Life Target Premium

Vul Vs Iul