All Categories

Featured

Table of Contents

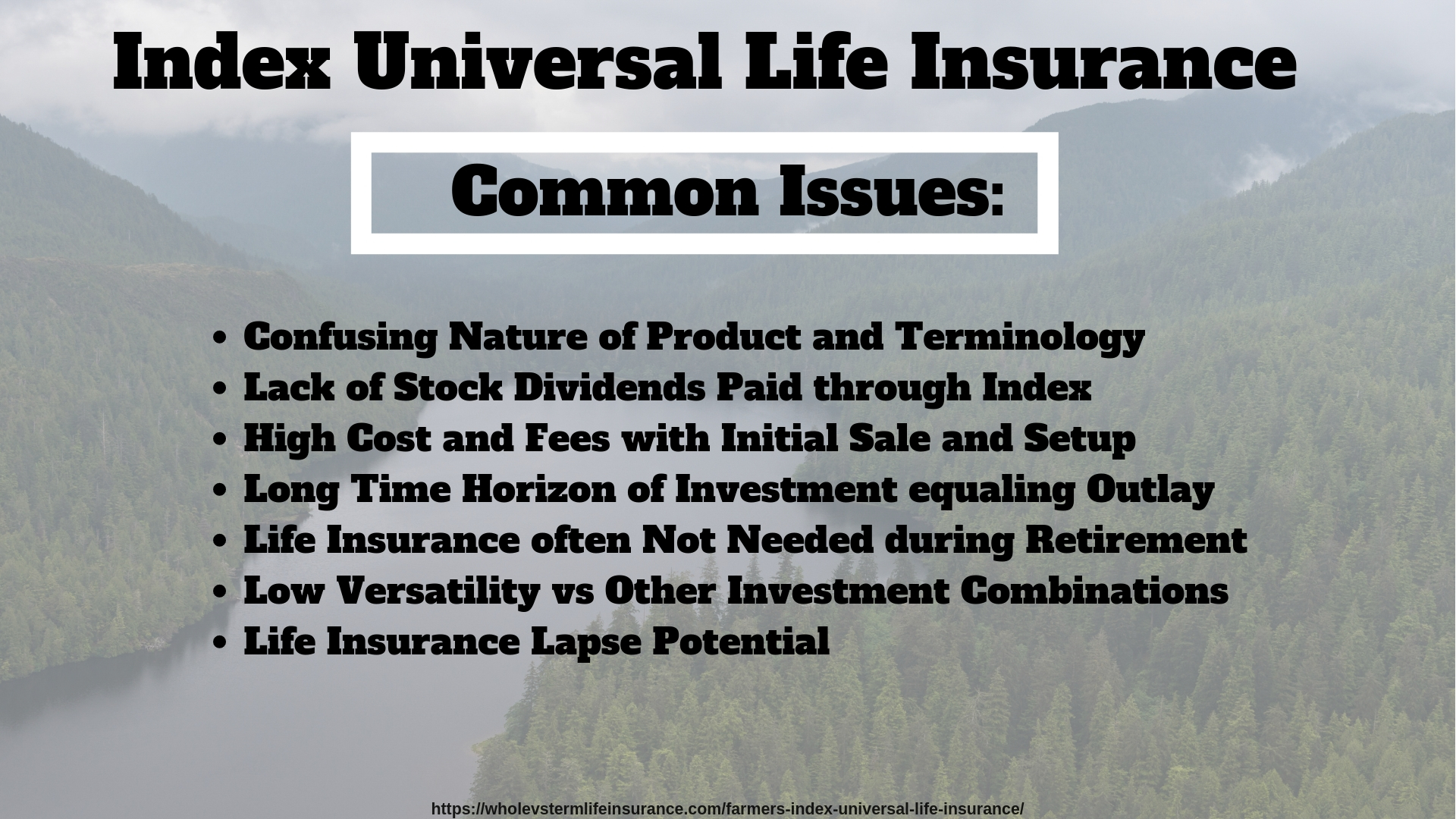

In the occasion of a lapse, outstanding policy car loans in excess of unrecovered expense basis will undergo common income tax. If a policy is a modified endowment contract (MEC), plan fundings and withdrawals will be taxable as common income to the level there are revenues in the policy.

Tax obligation legislations are subject to change and you should consult a tax obligation specialist. It is necessary to keep in mind that with an external index, your plan does not directly get involved in any type of equity or set income financial investments you are denying shares in an index. The indexes available within the plan are created to monitor diverse sectors of the united state

These indexes are criteria just. Indexes can have various constituents and weighting techniques. Some indexes have numerous variations that can weight parts or might track the effect of rewards differently. Although an index might affect your interest credited, you can deny, straight take part in or get dividend payments from any one of them with the plan Although an external market index may impact your interest attributed, your plan does not directly join any stock or equity or bond financial investments.

This web content does not apply in the state of New York. Assurances are backed by the monetary toughness and claims-paying capacity of Allianz Life insurance policy Firm of The United States And Canada. Products are released by Allianz Life Insurance Coverage Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Shield your loved ones and save for retirement at the very same time with Indexed Universal Life Insurance Policy. (Indexed Universal Life investment)

Iul Growth Strategy

HNW index universal life insurance policy can help collect money worth on a tax-deferred basis, which can be accessed throughout retirement to supplement revenue. (17%): Policyholders can commonly obtain against the money worth of their policy. This can be a resource of funds for different needs, such as spending in a service or covering unforeseen expenses.

(12%): In some situations, the cash value and fatality benefit of these policies might be secured from creditors. Life insurance can additionally aid reduce the threat of a financial investment portfolio.

What is the most popular Long-term Iul Benefits plan in 2024?

(11%): These plans use the prospective to earn interest linked to the efficiency of a securities market index, while likewise offering a guaranteed minimum return (Indexed Universal Life policy). This can be an eye-catching option for those looking for growth possibility with drawback security. Capital forever Study 30th September 2024 IUL Survey 271 respondents over 30 days Indexed Universal Life insurance policy (IUL) might seem complex at first, however comprehending its auto mechanics is crucial to recognizing its full possibility for your monetary preparation

For instance, if the index gains 11% and your engagement price is 100%, your cash money worth would certainly be attributed with 11% interest. It is essential to keep in mind that the maximum rate of interest credited in a provided year is covered. Let's say your chosen index for your IUL plan obtained 6% initially of June throughout of June.

The resulting interest is added to the cash money worth. Some plans compute the index acquires as the sum of the changes through, while various other plans take an average of the day-to-day gains for a month. No passion is credited to the cash account if the index decreases as opposed to up.

Indexed Universal Life Premium Options

The rate is established by the insurance business and can be anywhere from 25% to more than 100%. IUL policies normally have a floor, frequently established at 0%, which protects your cash money value from losses if the market index executes adversely.

The interest attributed to your cash value is based on the efficiency of the selected market index. The part of the index's return credited to your cash money value is identified by the involvement rate, which can vary and be readjusted by the insurance firm.

Shop around and compare quotes from different insurance policy business to discover the finest plan for your needs. Before selecting this type of policy, guarantee you're comfy with the prospective variations in your money worth.

What is the difference between Flexible Premium Iul and other options?

Comparative, IUL's market-linked cash worth development offers the potential for greater returns, particularly in good market problems. This possibility comes with the threat that the supply market performance may not deliver regularly secure returns. IUL's flexible costs payments and flexible survivor benefit offer adaptability, interesting those looking for a plan that can progress with their changing economic conditions.

Indexed Universal Life Insurance Policy (IUL) and Term Life Insurance coverage are various life plans. Term Life Insurance covers a certain duration, normally between 5 and 50 years.

It appropriates for those looking for short-term security to cover details financial obligations like a home finance or youngsters's education charges or for organization cover like shareholder protection. Indexed Universal Life (IUL), on the other hand, is a permanent life insurance coverage plan that gives coverage for your entire life. It is a lot more pricey than a Term Life plan because it is created to last all your life and provide a guaranteed cash payment on death.

What types of Iul For Wealth Building are available?

Picking the appropriate Indexed Universal Life (IUL) policy has to do with locating one that aligns with your monetary objectives and take the chance of tolerance. An experienced economic consultant can be indispensable in this procedure, directing you via the intricacies and guaranteeing your chosen plan is the best fit for you. As you look into purchasing an IUL policy, maintain these vital factors to consider in mind: Recognize just how credited rates of interest are connected to market index performance.

As laid out previously, IUL plans have numerous costs. A higher price can increase potential, yet when contrasting plans, evaluate the cash value column, which will certainly aid you see whether a greater cap rate is better.

What should I look for in a Guaranteed Indexed Universal Life plan?

Research the insurance company's monetary ratings from agencies like A.M. Best, Moody's, and Criterion & Poor's. Different insurers provide variants of IUL. Work with your advisor to comprehend and discover the ideal fit. The indices tied to your policy will straight impact its performance. Does the insurance firm offer a selection of indices that you desire to line up with your investment and threat account? Versatility is vital, and your plan ought to adjust.

Table of Contents

Latest Posts

Index Universal Life Insurance Tax Free

Universal Life Target Premium

Vul Vs Iul

More

Latest Posts

Index Universal Life Insurance Tax Free

Universal Life Target Premium

Vul Vs Iul